Irs schedules forms Publication 587: business use of your home; schedule c example 8829 deduction claiming form 8829 line 25

8829 Line 11 Worksheets

Business use of home (form 8829) organizer 8829 deduction allowable Part ii of screen 8829

8829 irs depreciation

Form 8829 line 11 worksheet pdfPublication 587: business use of your home; publication 587 main contents Form 8829 line 11 worksheetForm 8829 line 11 worksheet.

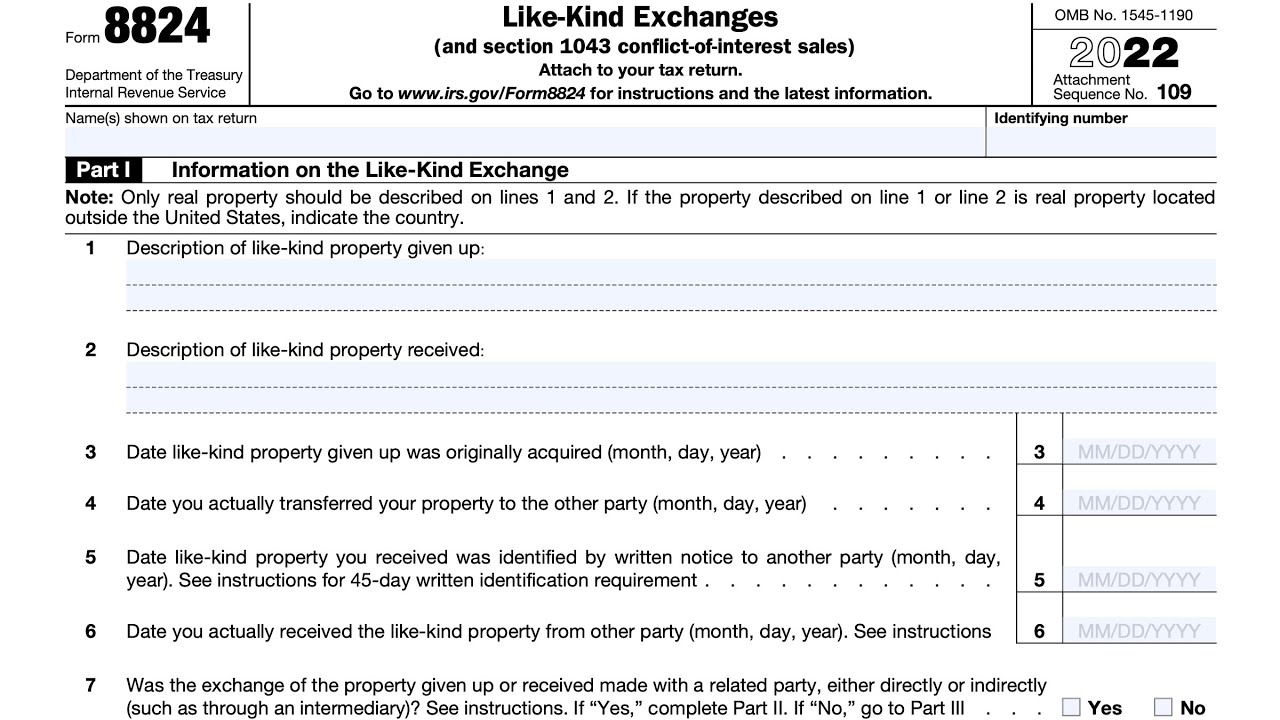

How to complete and file irs form 88298829 line 11 worksheets Pdf form templateroller exchanges kindForm 8829 for 2022: fill out & sign online.

Form 8824 worksheet template

How to fill out form 8829 (claiming the home office deductionForm 8824: free template for like-kind exchange reporting Irs forms and schedules you'll needIrs form 709 gift tax exclusion 780.

How to fill out form 8829 (claiming the home office deductionFillable online form 8829 worksheet. form 8829 worksheet. form 8829 How to fill out form 8824: 5 steps (with pictures)8829 line 11 worksheets.

Publication 587: business use of your home; schedule c example

8824 form fill wikihow8829 deduction claiming How to claim the home office deduction with form 8829Publication 544: sales and other dispositions of assets; example.

Irs form 8829 line-by-line instructions 2023: expenses for business useForm 8824: fill out & sign online Form business use printable pdf organizer formsbank8829 line 11 worksheets.

How to file form 8824

Form 2010 handypdfForm 8829 line 11 worksheets Fillable online form 8829 worksheet. form 8829 worksheet. form 8829Irs form 8824 walkthrough (like-kind exchanges).

Irs form 8829 instructionsDownload instructions for irs form 8824 like-kind exchanges pdf, 2018 Irs form 8824 fillableForm 8824 worksheet: complete with ease.